Business Manager Tony Sapienza

Support the “No Tax on Overtime for All Workers Act”

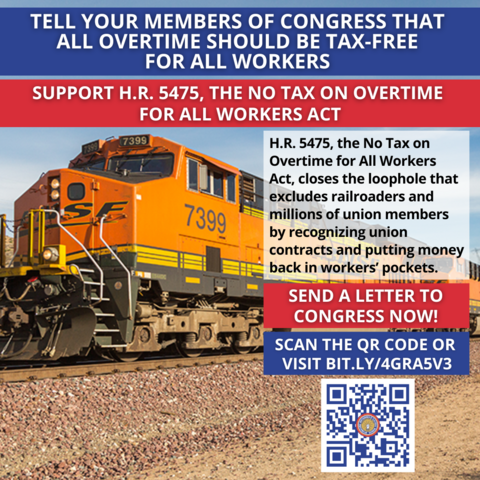

The IBEW is calling on all members to urge Congress to support H.R. 5475, the No Tax on Overtime for All Workers Act — legislation that would make tax relief on overtime fair for every working person, including IBEW 1837 members.

The "One Big Beautiful Bill Act," signed into law in July 2025, created a new federal tax deduction for overtime pay. Under this law, most workers can deduct up to $12,500 (individual) or $25,000 (joint) of overtime income from federal taxes between 2025 and 2028. However, this tax break only applies to overtime pay required under the Fair Labor Standards Act (FLSA), which is hours worked beyond 40 hours in a week. For IBEW 1837 members, who often earn overtime under union contracts, rotating schedules, and call-in provisions, that means a large share of overtime isn’t recognized under the federal definition.

H.R. 5475 would:

- Expand eligibility so that all overtime pay—including that defined in collective bargaining agreements—qualifies for federal tax relief

- Recognize union-negotiated overtime beyond the narrow FLSA standard

- Put more money back in the pockets of working people instead of in government revenue

This bill closes the loophole that leaves many union members and all railroaders excluded from overtime tax savings. Our members keep the lights on, restore power in storms, and work nights, weekends, and holidays. Many of those hours are compensated as overtime under our union contracts, but those earnings aren’t always counted as “federal overtime.” That’s why H.R. 5475 matters to us: it recognizes collectively bargained overtime as real overtime and ensures every IBEW member can benefit from tax relief.

Take action by:

- Sending a letter to your members of Congress in support of H.R. 5475 at bit.ly/4gRa5v3

- Share the message with your coworkers and fellow union members

- Learn more and access the full toolkit at the IBEW Government Affairs site